Tax considerations of holding cryptoassets for UK residents

22nd Oct 2021

What are cryptoassets?

Cryptoassets (also referred to as Cryptocurrencies) are a new asset class that has been developed over the last decade. They have changed dramatically throughout this time, and so has the government regulation surrounding them.

HMRC defines cryptoassets as “cryptographically secured digital representations of value or contractual rights” that have the potential to be transferred, stored and traded electronically. HMRC do not consider cryptoassets such as Bitcoin and Ethereum to be currency or money.

The government’s Cryptoasset Taskforce (CATF) identifies three types of cryptoassets: exchange tokens, utility tokens and security tokens:

Exchange tokens – these are intended to be used as a method of payment and include cryptocurrencies like Bitcoin and Litecoin. They do not provide any rights or access to goods or services.

Utility tokens - these provide the holder with access to particular goods or services on a platform usually using Distributed Ledger Technology (DLT).

Security tokens - these may provide the holder with particular interests in a business, including debt due by the business or a share of profits in the business.

Each type of token’s treatment for taxation purposes is based on the “nature and use of the token and not the definition of the token”.

Which taxes apply for individuals (UK tax resident)?

Gambling?

HMRC has clearly stated that they do not consider the buying and selling of cryptoassets to be the same as gambling. This means that unless the individuals are treated as engaging in financial trading in cryptoassets, cryptoassets are treated as capital assets, and investors who dispose of them must consider their capital gains tax.

Financial trader or Investor?

Anyone who buys and sells cryptoassets needs to consider if they are engaged in financial trading in cryptoassets, rather than simply assuming they are taxed under the capital gains tax regime (as an investor). Individuals who are classified as financial trading in cryptoassets are required to pay income tax and national insurance on their profits, rather than capital gains tax on their capital gains. Therefore, being classified as a trader rather than an investor usually results in a higher tax bill.

Fortunately, HMRC has stated in their Cryptoasset Manual at CRYPTO20050 that “In the vast majority of cases, individuals hold cryptoassets as a personal investment, usually for capital appreciation or to make particular purchases. They will be liable to pay Capital Gains Tax when they dispose of their cryptoassets.” HMRC go on to say “As set out in CRYPTO20250 there may be cases where the individual is running a business which is carrying on a financial trade in cryptoassets and they will therefore have taxable trading profits. This is likely to be unusual, but in such cases, Income Tax rules would take priority over the Capital Gains Tax rules.” HMRC go even further than this in CRYPTO20250 where they state “only in exceptional circumstances would they expect individuals to buy and sell exchange tokens with such frequency, level of organisation and sophistication that the activities amount to a trade-in itself.”

Consideration of whether or not an individual is engaged in financial trading is a very complex area. It is not as simple as working through the ‘Badges of Trade’ as these have been demonstrated to have limitations in the context of financial trading. The relevant considerations have been detailed in the Appendix to the Recap UK Tax Guide for Individuals which explores the approach HMRC would take to gather the facts of the case and summarises relevant case law on the topic.

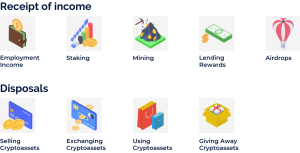

Taxable Events

Sources of further information:

Sources of further information:If you need any support with your cryptoassets or would like more information please get in touch with one of our crypto specialists.